Financial Integration Key to Trade Growth in Asia

During her recent visit to Jakarta, Christine Lagarde, managing director of the International Monetary Fund, highlighted the need for Asian countries to strengthen their role in the global economy by allowing exchange rates to float, improving oversight of the financial sector and strengthening financial integration.

Some of my recent work discusses the first two points (Bussiere et al. (2015) and Lopez et al.(2015)) while a new report, “Trade Finance: A Catalyst for Growth in Asia,” tackles the proposition that trade and financial integration are essential to shared, sustainable growth.

Previous experience has shown that the impact of trade liberalization on growth is short-lived unless it is accompanied by financial deregulation to expedite the flow of capital to exporters and importers. In the case of ASEAN countries, trade integration requires financial integration as well. To this end, the ASEAN Financial Integration Framework (AFIF), a component of the planned ASEAN Economic Community, was approved in 2011 and has a target end date of 2020. Yet, in a recent speech, Ravi Menon, managing director of the Monetary Authority of Singapore, expressed concern that progress on AFIF has been slow.

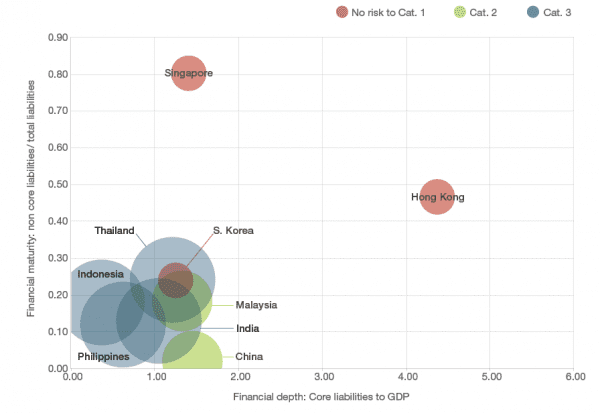

Moving forward is critical because Asian trade is highly dependent on bank-intermediated financing (see Figure 1). Banks tend to focus on creditworthiness and, as a result, are unable to accommodate a large percentage of requests from small and medium-sized enterprises (SMEs), especially in the less developed countries. (Consequently, several alternatives such as inter-firm credit or global and regional value chains are becoming more popular.)

The importance of trade and financial integration was further underscored in the aftermath of the financial crisis, which prompted U.S. and European banks to become, at least temporarily, less active in the region. Asian banks gained market share, but the differences from country to country in infrastructure and support systems (banking, insurance, advice, networks) remain a primary concern of lenders considering funding requests from SMEs and less-developed countries.

Figure 1: Financial development and Risk Assessment per Country

Source: Lopez et al (2015). Note: financial maturity measures how much the country’s financial system funding relies on non-depository corporations while financial depth assesses the size of the depository corporations relative to the country’s real economy. The size and color of the bubble represent the risk classification provided by the OECD, dictating the minimum premium rates of credit risk.

Our report asserts that regional integration must be combined with standardized processes that reduce reliance on paper documents in favor of electronic and Web-based platforms while easing cross-border procedures. Simultaneously, policymakers should create international criteria to streamline the trade finance process and regulations. These steps will help widen the pool of lenders and investors and ease access to affordable capital, two key elements of continued prosperity.